Thursday, November 12, 2009

Mortgage market update

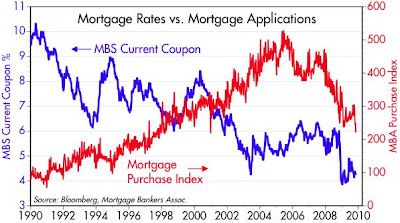

I decided to post these charts after seeing a headline to the effect that new applications for mortgages had fallen to a 9-year low. Could this have something to do with the phasing out of the tax credit for first-time buyers? The first chart here would say in answer to that: not much. New applications for mortgages have been steadily declining for the past four years, even though mortgage rates today are almost as low as they've ever been (which should be worth at least as much as the tax credit). I think it's just the tail end of the housing bubble deflating. Ten years ago, today's level of new applications would have been considered extremely healthy; it was when the market became frenzied in the early 2000's that things started spinning out of control.

Another side of the story is mortgage refinancings, shown in the second chart. With the exception of a few brief spikes in the past 10 years, refi activity has been gradually trending up as mortgage rates have trended down. This is exactly what one would expect to see.

This is a good time to put in a plug for fixed rate mortgages. Fixed rates, as shown in the next chart, are very close to all-time lows. Refinancing an existing mortgage or planning to get a new mortgage? Go with a fixed rate. If interest rates go up, you have locked in a very low rate from an historical perspective. If rates go down further, you simply refinance, and the cost to do so is generally quite low. Adjustable rates might be very tempting, but they are also very risky. It's not a question of if short-term rates rise, it's a question of how much they rise. If inflation starts to heat up, short-term rates (the basis for adjustable rate mortgage rates) could rise by much more than the market currently expects.

One thought is applications slowed because people were waiting for the renewal of the tax credit. There were reports of larger credits (up to $11,000) and opening it up to more people. In the end, the tax credit is extended and a new credit is available to people who have owned their house for 5-years or more. This may pump house sales some. Here in Minnesota, house sales slow as winter sets in. We're having a warm start to November, so maybe we get a nice bump before it gets cold.

ReplyDeleteI would be concerned if mortgage application stay around the level from 10 years ago for a prolong period. In the last 10 years, US population grew and demand should have grow too.

ReplyDeleteI would guess a reasonable value for the MBA purchase index if we use the growth rate trend prior to 2000 is around 400.

The recent big dip is a little worrisome. Is the mba purchase index seasonally adjusted?

Gary's observation, that the slowdown in new applications was due to the anticipated expiration of the tax credit, may be correct. If so, with the tax credit having been extended, apps may pick up again.

ReplyDeleteThe data is seasonally adjusted.