Friday, November 13, 2009

Baltic and trade update

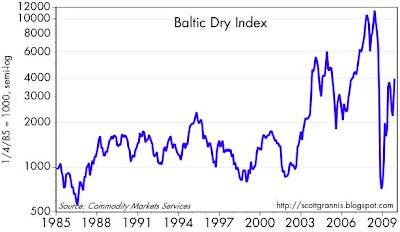

Both these measures of shipping costs for bulk commodities have strengthened meaningfully over the past two months. U.S. goods exports are up at a 34% annualized rate in the five months ended September. Spot industrial commodity prices are up 33% from their lows of late last year. Clearly, the wheels of global commerce are spinning back up. Skeptics continue to claim that this huge and pervasive rebound in activity and pricing is being driven by mindless Chinese stockpiling of commodities. I think it must go far beyond that. Everything I see is consistent with a global recovery in confidence, in demand, and in production.

Accommodative monetary policy undoubtedly is playing a role here, but for now I view it more as facilitating the recovery in confidence that is necessary to get things going. At the end of last year, the world's investors and businesses were frozen by the terror of counterpary risk, and the demand for money was almost overwhelming. This demand desperately needed to be satisfied by the world's central banks, and they have complied. Now that things are back on track, however, they should start to reverse their massive liquidity injections. The longer they wait, then the greater the risk that the upturn in demand that we are seeing will get blown out proportion by speculation.

I've noticed that companies in Japan freigh sector are making new lows or drifting near.

ReplyDeleteHi Scott,

ReplyDeleteYou mentioned the recovery of confidence to get things going again. I've just remembered the global savings glut! I think that could be the rocket fuel waiting for the spark of returning confidence.

There were multiple causes to the subprime crisis. However, there is a very strong case that the fuel is the global savings glut. Back in 2005-2006 (can't remember now), when Greenspan raise short term rate he was surprised the long term rate didn't move. At one point the yield curve was inverted because there was so much money chasing return.

Surprisingly, the size of the savings glut has only grown since the start of the crisis. I can't remember where I saw the stats, but I believe the size of the savings glut is up by +20%. Perhaps because people increased their saving because of the crisis. In other words, the rocket fuel that powered the housing bubble is still here and is bigger. Today, people's risk appetite and confidence are much lower because of the crisis. Low risk appetite won't last. It has improved and is improving. The fuel probably went into low yield government bonds for now. The fuel is just waiting for a spark.

Many have underestimated the strength of the recovery thus far. Their underestimation could get much wider.

What do you think?

Thanks for bringing up the subject of the so-called global savings glut. I was skeptical of this from the very beginning, but while working with the IMF on a project in Chile last year I acquired a better understanding of what may be happening. The origins of much of the savings may well be the Sovereign Wealth Funds that are used by many countries around the world, notably in the Middle East and Asia (and also in Chile). The countries have large export surpluses, and the SWFs generally end up absorbing a good deal of the surplus and investing it outside the country. The fruits of the country's export efforts are thus "saved." Most of the investments targeted by these funds are relatively safe assets such as Treasuries. If this represents the source of a savings "glut" then it is because these funds are a suboptimal way to manage these countries' growth. In other words, they would be better off allowing the citizens to spend the export surplus in whatever way they wanted.

ReplyDeleteIf these funds were shut down or if they changed their operating procedures, it is likely that a good portion of the money currently directed to the purchase of safe assets would instead be directed to the purchase of U.S. goods and services.

Thanks Scott.

ReplyDeleteTo your last point, I think the money is being quickly channeled into US goods and services in an indirect way. The Treasury is financing the US deficit spending through the sales of bonds. Therefore, the money is very quickly entering the US economy via a short stop at the Treasury. Investment efficiency is a whole different story.

Amusingly, this can be viewed as the SWFs outsourcing their investments decisions to the US Treasury! In this way, the SWFs avoided various investment specific risk but took on massive currency risk. I think the SWFs have learned this lesson very well this year. The SWFs are gradually changing by investing in commodities and foreign companies. This is helping asset prices.

I think the SWFs will strike a new balance on taking specific investment risk and currency risk. The speed of the rebalance will depend on their confidence in the economy and their confidence in their own ability to manage these risks. As they do this, the affect could be big.

There is one more thing to note about the savings glut. One explanation of the housing bubble is as follow. Prior to the current crisis, the huge savings glut depressed the treasury bond yield significantly. This than depressed the yields of other risky debt instruments such as mortgage back securities. This provided the fuel for the housing bubble. One evident may be the inverted yield curve when Greenspan tried to raise short term rate a few years ago. Because SWFs have been cautious and invested mostly in Treasuries, they largely survived the down turn whole and have grown. Therefore, the source of the low treasury bond yield is still here. However, what about the affects? In the short term people are still afraid. What about the medium and long term when confidence come back?

I find it amazing that nations, and not just investors, will outsource their investement decisions.