Thursday, October 29, 2009

Fed and Treasury update

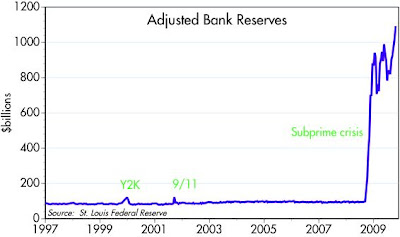

The Fed continues to expand bank reserves (first chart), but its balance sheets remains relatively unchanged in aggregate over the past year (second chart, source here). Further, as seen in the second chart, the Fed has bought enough Treasury bonds by now to replenish what it "lost" in last year's panic, flight-to-quality. They will continue to buy agency and mortgage-backed securities, but these purchases will likely be offset by declines in the "other" categories.

The big question thus remains: how and when will the Fed start reversing this huge addition to bank reserves? The Fed will eventually have to sell, by hook or by crook (and it is already experimenting with ingenious ways to do this) about $1 trillion worth of agency and MBS. Whether this by itself will push interest rates up, or whether rates will rise because the economy is picking up and that is the justification for the Fed to reverse its liquidity injections, it doesn't much matter. The bottom line is this: if the economy continues to grow at a 3-4% rate, as seems likely to me, then interest rates on Treasury bonds are going to go up significantly, and rising Treasury yields will in turn push agency and MBS yields higher as well.

The market is currently happy with 3.5% yields on 10-yr T-bonds, but only because the market doesn't believe that this economy has the potential to post continued, decent rates of growth. If and when that perception changes to one of expecting 3-4% growth (or even more: see my previous post), then Treasury yields will inevitably move significantly higher. So it's not worth your time worrying about how the Fed will reverse its quantitative easing; the main driver of interest rates will be economic growth. And of course inflation is going to play a role in rising rates as well, but the market won't worry about inflation until it first becomes convinced that the economy has the ability to grow by at least some decent rate.

When it comes to Treasury yields, it's all about economic growth.

No comments:

Post a Comment