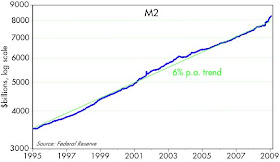

This is my longest-running theme: namely, that this recession has not been the result of a monetary squeeze or a shortage of money, contrary to the popular belief that the economy has ground to a halt because banks are not lending and credit markets are frozen. M2, my favorite measure of money, has grown about 10% in the past year, and has surged at a 17% annualized rate over the past four months. The problem is not a shortage of money but a shortage of buyers, which in turn is the result of a sudden aversion to counterparty risk. Granted, secondary lending activity (of the sort that gave us CDOs and Asset-Backed Securities) has ground to a halt, but that does not mean that credit creation has collapsed. On the contrary, total bank credit is up 4.5% in the past year.

The secondary markets served the function of distributing the credit created by banks from the far corners of the globe, and into the nooks and crannies of our own economy. Indeed, money was funneled from global lenders to borrowers everywhere, which is why the collapse of our housing market has led to losses worldwide. There is plenty of money out there today, but it is harder for some borrowers to get their hands on it. Today, many lenders prefer to only invest in government securities, having been severely burned in the past by lending via asset-backed paper they assumed was relatively safe. This is why the U.S. government will be able to finance a mega-deficit this year and only pay about 2% in interest to do it.

In short, there is an abundance of money out there, but a shortage of holders of that money that are willing to lend it to borrowers with less than sterling credentials. This is the primary justification for all the federal bailout programs, since at the end of the day what those activities amount to is the U.S. government buying the paper that no one wants, in exchange for the Treasury securities that everyone wants.

So the key to restoring our economy to a healthy state is to boost confidence, reduce perceived counterparty risk, and generally increase the market's willingness to take risk. Tax cuts on capital could have gone a long way to fixing the problem, but alas, they have been passed over in favor of politicially motivated spending which will do very little to address the economy's underlying problems.

The doomsayers out there mostly assume that we are caught in the grips of a liquidity trap (in which no amount of money creation is sufficient to boost demand) and/or we are in being sucked into a deleveraging death spiral that won't end until vast sectors of the global economy are devastated. What they most likely ignore is that economies, especially ours, are incredibly dynamic, and that makes forecasting the future very difficult. It is risky to assume that any trend that is readily observable will continue forever. Recessions are not self-perpetuating.

I have been operating under the assumption that the vast majority of the real-estate-related losses have been absorbed by the holders of affected securities. I think that home prices are in many areas already at levels which have stimulated buying demand, thus acting to put a floor under those prices. With money policy extraordinarily easy, I have been thinking that investors will not want to sit on mountains of cash indefinitely, especially when they see that sensitive asset prices (e.g., oil, commodities, real estate) are stabilizing, and especially when that cash is paying them almost nothing in interest. The confidence that has been lacking to date can be restored as animal spirits and the profit motive come back to life. In other words, I am a believer in the market's ability to fix itself, and I see more examples of that happening.

It still pays to be optimistic, even thought the stimulus package is awfully depressing.

some of the problem is confidence, some of it is the structural issues in the banking sector.

ReplyDeletebut another part is that the economics of capital invested in the US economy are fundamentally changing. stagnating US wages and a US consumer that is retrenching into savings mode, presents a slightly different opportunity set for investment.

'back to the future' is not a prescription for economic prosperity in this country.

I have a problem with the savings rate. To begin with, it is not measured correctly, since it counts realized capital gains and losses but doesn't count unrealized gains and losses. Second, there is no reason why a rise in the savings rate here should mean slower growth. Every dollar that one person saves is always and necessarily spent by another person; there is no way to save money (aside from literally putting it under your mattress) that does not involve giving that dollar to someone else so that they can in turn spend it on something.

ReplyDeleteThe savings rate is almost meaningless, really. The key is work, investment, and production. That's what drives the economy.

Scott, thanks for your great blog. I'm curious to know your thoughts on the SP500. It looks like it may be about to test new lows. How do you think it will play out given your conviction that there is already a chink of light at the end of the tunnel? Thanks again. - Rob

ReplyDeleteMy thesis is that the equity market has priced in all the bad news already. I don't believe the economy will get as bad as the market expects. In earlier posts I note how the pricing today implies a future economy that is much worse than the Depression. I don't see that. So as long as the economy doesn't slip into a mega-depression, then stocks should eventually rise.

ReplyDeleteI think the lows of November will hold, but I am keeping some powder dry in case we break to new lows. You can never know anything with certainty.

regardless of the exacting nature of the savings rate, it is fundamentally going up.

ReplyDeleteeven if people save a dollar and it is available to be lent out by a bank to other individuals or companies, the opportunity set for an attractive ROI has declined....

unless we finally get trade policy right and expand our export business.

im skeptical that productivity in the next 10-20 years will be as enhanced as it was during the last 10-20. with incomes stagnating/gdp more muted in nature, it seems a bad idea to bet on the US consumer as your customer.

The market has miscalculated this disasters every step of the way. We will blow through the lows.

ReplyDeleteOur government has already thrown everything it can at the economy but to no avail. Numbers are meaningless at this point because nobody beleives it will work or that the government knows what it is doing. That is the reality that is shaping our future.

If the so-called saving rate increased meaningfully, that would be reflected (because of the accounting treatment) in an improving trade balance, which would probably take the form of more exports and a slowing or decline in imports.

ReplyDelete