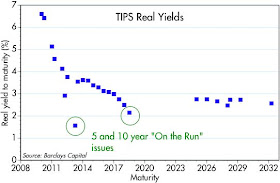

Yesterday the Fed announced they would be using the "on the run" 5- and 10-year issues for purposes of calculating the current real yield of benchmark TIPS, instead of interpolating between the yields on issues closest to having 5 and 10 years to maturity. This chart shows just how much those two issues stand out from the pack. Their yields are much lower than that of their next-door neighbors, which means demand for these issues is exceptionally strong. And the reason for that lies in the deflation protection that those issues have.

Yesterday the Fed announced they would be using the "on the run" 5- and 10-year issues for purposes of calculating the current real yield of benchmark TIPS, instead of interpolating between the yields on issues closest to having 5 and 10 years to maturity. This chart shows just how much those two issues stand out from the pack. Their yields are much lower than that of their next-door neighbors, which means demand for these issues is exceptionally strong. And the reason for that lies in the deflation protection that those issues have.When TIPS are first issued, their principal is $1000 per bond. That principal gets adjusted every day for a prorata share of the change in the CPI two months earlier. When inflation is positive, the principal goes up, and when it's negative, as it was last month, the principal gets adjusted down. So in a period of persistent deflation, the principal value of TIPS could decline signficantly. Except, however, if you hold an issue to maturity. At maturity, every TIPS issue will be paid off either at its inflation-adjusted value or at $1000, whichever is greater. TIPS issued many years ago (and which currently have an adjusted principal value substantially higher than $1000) could thus suffer losses in their principal value in a extended deflation scenario, whereas recently-issued TIPS would have significant protection against deflation.

From the anomalies on this chart, we can deduce that, since the market is willing to pay a significant premium for recently-issued TIPS, the market is seriously concerned about the possibility of an extended period of deflation in the U.S. Consider the real yield on 9-year TIPS: at 2.77%, it is just about equivalent to the current yield on 10-year Treasuries. Which means that the market is implicity betting that the average inflation rate over the next 9 years will be about zero (this is the breakeven inflation rate, in technical terms, the amount of inflation needed for an investment in TIPS to equal the return on an investment in Treasuries of similar maturity). Further implicit in this forecast of future inflation is the strongly-held view that inflation is going to be significantly negative for the next few years, followed by some positive inflation. In short, the market is betting that we are on the brink of a deflationary depression.

If you're not worried about outright deflation, then you can ignore the on-the-run issues and concentrate on the superb real yields offered on all the other issues. Or you can buy a fund that invests in either all TIPS issues or a maturity subset of TIPS.

No comments:

Post a Comment