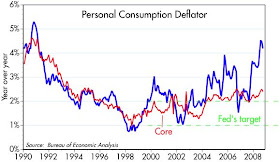

The nominal yield on a 5-year Treasury bond and the real yield on a 5-year TIPS bond are identical today, which means that the bond market is expecting consumer price inflation to average zero over the next five years. This chart is a reminder that price stablity is a long way away from where we are today. The Fed has told us that the personal consumption expenditures deflator (both with and without energy) is the preferred measure of inflation, since it is a broad measure of prices and doesn't suffer from some of the biases that the CPI has. Inflation have been above the Fed's 1-2% target for over four years now. I remain very skeptical that inflation will fall as much as the market expects.

The nominal yield on a 5-year Treasury bond and the real yield on a 5-year TIPS bond are identical today, which means that the bond market is expecting consumer price inflation to average zero over the next five years. This chart is a reminder that price stablity is a long way away from where we are today. The Fed has told us that the personal consumption expenditures deflator (both with and without energy) is the preferred measure of inflation, since it is a broad measure of prices and doesn't suffer from some of the biases that the CPI has. Inflation have been above the Fed's 1-2% target for over four years now. I remain very skeptical that inflation will fall as much as the market expects.The bond market has never been very good at predicting inflation. That's because of the pervasive view that a weak economy will reduce inflation while a very strong economy will push it up. That has the causality all wrong. Rising inflation is bad for growth, since it tempts people to speculate (e.g., by buying homes, gold, commodities and other currencies), while low inflation is good for growth, since it encourages people to invest (e.g. by buying things which lower costs and increase productivity).

No comments:

Post a Comment