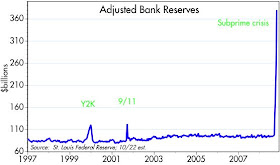

As this chart graphically illustrates, the Fed has entered "quantitative easing" mode with a vengeance. The only parallel to this that I'm aware of is when the Japanese central bank doubled bank reserves in 2001 and again in 2002, and then increased them another 50% in 2003. That was considered to be beyond the realm of the possible for developed countries back then, but now the Fed has quadrupled bank reserves (according to my estimates) over the past six weeks!

As this chart graphically illustrates, the Fed has entered "quantitative easing" mode with a vengeance. The only parallel to this that I'm aware of is when the Japanese central bank doubled bank reserves in 2001 and again in 2002, and then increased them another 50% in 2003. That was considered to be beyond the realm of the possible for developed countries back then, but now the Fed has quadrupled bank reserves (according to my estimates) over the past six weeks!It took about four years for a massive expansion of raw money supply to reverse Japan's deflation, but reverse it did, and inflation in Japan is now 2% instead of being negative. I think we can safely assume that it won't take that long for the Fed's current efforts to get us out of this financial crisis. But some intense prayer might not hurt in the meantime.

The scope of the Fed's response to this crisis is beyond anything that could have been imagined just weeks ago, so we can only speculate about the future might hold at this point. But this we do know: this financial crisis (as I've mentioned previously) is all about people wanting fewer things and more money (many describe this as a massive deleveraging of the system). And the Fed is determined that people will not be disappointed.

The demand for money has soared in recent weeks as investors have fled equities, commodities, gold and foreign currencies in favor of cash. By flooding the banking system with reserves, the Fed is responding to this increased demand for money and they are taking no chances—they are supplying reserves in excess of the market's demand for them, as evidenced by the fact that the federal funds rate has traded below the Fed's target almost every day since they began their quantitative easing. In effect, they have abandoned their fed funds targeting procedure in favor of simply throwing reserves into the system as fast as they can figure out which assets to buy to expand their balance sheet.

Eventually (and that is the rub, because we don't know how long this will take), a massive expansion of bank reserves should at the very least forestall or reverse any deflationary tendencies that might result from the current financial crisis. As I have said before, now is not the time to worry about deflation.

If the crux of the current crisis is that there is an excess of "things" (e.g., equities, real estate, commodities, gold) because people want more money instead, the Fed is all but guaranteeing that there will be no shortage of money available to those willing to buy "things" from those wishing to sell them.

Hi 'Uncle' Scott!

ReplyDeleteIt was good to finally meet you...oh wow, nearly two weeks ago, my how time flies...at the Haralambo's beach house two Sunday's ago! I really enjoyed getting to hear you all discuss the current economic situation, along with the various implications and reasons for it.

I was wondering if you have had a chance to read over some of the articles concerning Greenspan's "confession" to the error in his economic policy, and if so, what your own thoughts on the matter were. I'm not usually one to cry "conspiracy!" but I can't help but wonder if any behind-the-door talks took place to firm up another scapegoat for the current economy.

Again, it was wonderful you finally meet you, and until I get to listen in again on your conversations, I'll just keep reading your blog!

Scott,

ReplyDeleteI came across a book on a von Mises blog (www blog.mises.org/blog/) titled 'The Ethics of Money Production' by Jorg Guido Hulsmann and published in 2008 by the Ludwig von Mises Institute. I read through the book and thought you may find it interest.

NOTE: You can actually read the book at this site by scrolling down until you see the book cover; then clicking on the arrow to the right edge of the book. This will flip you through the book's pages.