This all but guarantees that the Fed soon will be scaling back on its tightening agenda. For my money, the FOMC's November 2 rate hike (from 3.25% to 4.0%) should be the last, but a hike next month of 50 bps (to 4.5%) is likely to be the Fed's last move for the foreseeable future. The Fed simply can't react as fast as the market does to changing realities—unfortunately, the Fed is usually "behind the curve." In any event, a 4.5% funds rate by year end is fully priced into the market and thus it should not be very impactful. What will change though is the market's expectation for where rates will be a year from now: lower than currently expected, and that is what is driving equity prices higher.

What's most important is that the market is now beginning to see across the valley of uncertainty to a time when inflation comes back down to 2%. It may take up to a year for that to happen, however, but as long as we know that the worst is over, markets can anticipate a lower-inflation future and equity markets can drift higher. And although it's very good news that inflation has peaked and is now declining, the bad news is that thanks to the 2020-2021 explosion of M2, the general price level will have suffered a major increase that is unlikely to be reversed. Real incomes have suffered and it will take a long time for them to recover.

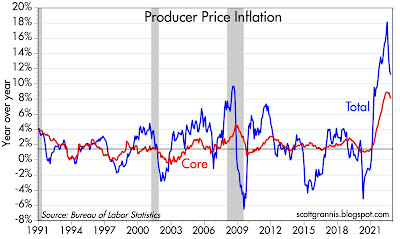

Chart #1

Chart #1 shows the year over year changes in the total and core (ex-food and energy) versions of the Producer Price index. Both peaked about six months ago, and that was about six months after M2 stopped growing.

Chart #2

Chart #2 shows the 6-mo. annualized change in the total and core versions of the PPI; this highlights the degree of change that has occurred in the past six months.

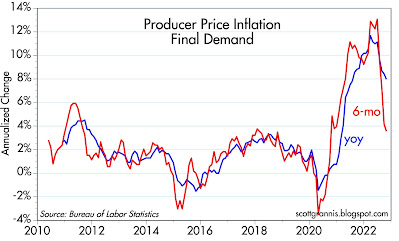

Chart #3

Chart #3 shows the year over year and 6-mo. annualized changes in the final demand version of the PPI (a version which began in 2009). Here the change is even more dramatic. Overall, these three charts tell a story of a rapid deceleration in the growth of prices in the early stages of the supply chain. These changes are likely to be reflected in the months to come in a moderation of the growth of the CPI.

Chart #4

Chart #4 shows the ex-energy version of the CPI index (plotted on a log scale so that changes in growth rates can be more easily visible). This version of the CPI (which I think is best because it eliminates the extreme volatility of energy prices) has been growing at about 2% per year for a long time. After March 2021 it suddenly picked up to a 7% rate of growth. It is likely to continue to grow faster than the former 2% annual trend for perhaps the next 12-15 months even as the year over year growth rate declines. I'm guessing that when the CPI returns to a 2% annual growth rate, the index will be at least 10-12% higher than the original 2% trend, and that would be about 20% above the level of March '21. Meaning, of course, that the price level will have experienced a one-time increase of at least 10% on top of its typical 2% annual rise.

Inflation will be with us for some time to come, but its rate of increase will continue to moderate. This doesn't mean the Fed has to continue to tighten, however. Just maintaining its current stance would probably be sufficient to get inflation back down to 2%. That assumes, however, that M2 growth continues to be essentially flat and the government avoids sending out another massive batch of checks funded with the printing press.

Welcome back, Scott ! You were missed!

ReplyDeleteThanks. We were relaxing at our favorite spot in Maui: Napili Kai.

ReplyDelete"checks in 2020 and 2012 peaked"

ReplyDelete2012? I think you have a typo there.

Napili Kai and not Kihei?

ReplyDeleteI don't even know you any more.

John A: thanks for spotting that typo.

ReplyDeleteK T: I'll take Napili any day over Kihei. Give it a try.

This comment has been removed by the author.

ReplyDeleteScott, thank you for your thoughts on current situation.

ReplyDeleteIf FED pivots near term it would mean that foreign currencies will go up in relation to the USD.

Strengtening foreign currencies further from now will increase USA CPI because of trade imbalances USA vs. rest of the world (USA imports much more then exports).

We know that the FED is fighting with inflation so they do not want to launch second phaese of increasing CPI. Maybe FED should hold/increase rates much longer then market expects ?

Another issue is offshore dollar market - we have experienced this year many "cracks" in world economy - yen devaluation, yuan devaluation, euro devaluation, SNB swap lines with FED, UK bond crisis, etc. which indicates global lack of dollars for international trade, lack of collateral. Do not you think that offshore dollar market dwarves what happens in USA and we should watch carefully how world economy is reacting rather on dollar shortage rather then paying attention to FED and USA as a main cause of dollar valuation rollercoaster ?

What are you thoughts if you do not mind to share ?

Cleveland's CPI inflation nowcast is down to 5.4% in the 4th qtr. of 2022. Atlanta gDpnow cast is up to 4.0% in the 4th qtr. 2022. That corresponds to money flows, the volume and velocity of money. That corresponds to the peak in the 2nd wave in the Elliott Wave theory.

ReplyDeleteThe FED is operating the economy in reverse. It needs to increase the supply of loan funds, lowering interest rates, while keeping the supply of money, DDs, unchanged. The 1966 Interest Rate Adjustment Act is the template.

ReplyDeleteThe cracks in the US Treasury bond market | Financial Times (ft.com)

so you call it a pivot but it's more like a pause

ReplyDeleteGreat outlook by Scott Grannis, whether or not you agree with him exactly on every point.

ReplyDeleteI think Grannis is roughly right, and you know the old saying, "Better roughly right than exactly wrong."

Beyond that, after watching macroeconomics for 50 years, I never saw anyone who was more than roughly right. And quite a few big names who bungled a few calls.

I hope the Fed is listening.

BTW, central banks around the world are tightening up, trying to keep their currencies stable against the US dollar, including many ASEAN central banks, among others.

We also see the Reserve Bank of Australia, the ECB, the Bank of Canada tightening up.

Oddly enough, almost all were "loose" until rather suddenly the inflation cat got out of the bag.

The Bank of Japan and the People's Bank of China are outliers, and likely will not tighten much more or at all.

Not sure what this means, or how to play it as an investor. But central banks may trigger a global slowdown.

Economists simply can’t differentiate between an individual bank and the system. The equation, the capacity of a single bank to create credit as a consequence of a given primary deposit (and newly created deposits flow to other banks), is also applicable to a nonbank, financial intermediaries.

ReplyDeleteBut this comparison is superficial since any expansion of credit by a commercial bank enlarges the money supply, enlarging the system, whereas any extension of credit by an intermediary simply transfers ownership of existing money within the system (a velocity relationship).

This comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDelete"so you call it a pivot but it's more like a pause"

ReplyDeleteYes. The Fed is soon going to pivot from an aggressive tightening stance to a wait and see stance. I think this will turn into a long pause as next year unfolds.

Thanks for your comments, and what's your take on recession scenario?

ReplyDeleteMy take on the recession scenario: First, despite small negative growth numbers in the first two quarters of this year, I don't think it reached the magnitude of a recession. A recession almost by definition requires negative industrial production and significant job losses. Instead, industrial production was strong and job gains were strong.

ReplyDeleteAs for next year, the risk of a recession rises to the "significant" level only if the Fed continues to pursue an aggressive tightening of monetary policy. As I argue in this post, I don't think this will happen. A Fed pause followed by cuts in the Fed funds rate would take a lot of pressure off the economy and the housing market via a reduction in longer-term interest rates and mortgage rates. Gridlock in Washington means that we can be spared policy excesses from both parties, thus avoiding the headwinds of more regulation and higher tax burdens.

In any event, I doubt we will see robust growth. The economy is already bearing a heavy burden of regulations and taxes. 2% real growth is about the best we can hope for.

Of course this assumption presupposes that the Fed will do the right thing. And when was the last time the Fed got the timing of rate changes correct?

ReplyDeleteBad behavior doesn’t develop overnight. Think of obesity in the US, it did not happen overnight; but slowly, if your neighbor was 10 lbs heavier, it allowed you to think you could be 10 lbs heavier, and then 20 and so on. Same with drugs, social problems, general social behavior.

ReplyDeleteSince going off the gold standard, it took some time for us to get used to just printing money to solve our problems. Now it is standard. We got lucky after the great recession as far as inflation - that people were saving and not borrowing so much.

All these things relate to character, courage. There is very little of it in the West anymore. It is unlikely that we can even produce a Volker now.

Who really thinks that the Fed will stay strong when the next crisis hits? None of us do. But that false assumption underlies any argument that we can return to 2% inflation.

And there will no doubt be many more crises, very shortly, to test - who else, the Fed: our savior for all our bad behavior.

Richard

p.s. Scott

ReplyDeleteI am having trouble subscribing with the links that are presented; netvibes is blocked by Google as suspicious, and the Yahoo link does not work. Atom link just is gobblygook. Any ideas?

Richard

Unknown Richard: I admit to being semi-illiterate when it comes to such links. I'd welcome suggestions from readers. For now, the only thing that really seems to work is to follow me on Twitter. I like Twitter much more now that Musk is in charge.

ReplyDeleteWhat I probably should do is switch to Substack or WordPress. But it requires an investment of time that I seem to lack.

Better to go to Substack. Then you automatically notify your users and are able to charge as well.

ReplyDeleteGoing directly to blogger.com allowed me to add your newsletter (as blogger is owned by Google I see, I guess I didn't even half to register). I assume that I will now get emails of your posts.

ReplyDeleteHowever, I see that it is still naming me as "unknown", instead of using my google username.?

All of the links work fine for me. I say leave well enough alone. I would suggest clearing your browser cache, updating browser , restart computer, or even get a newer computer, if you are having issues. Good Luck.

ReplyDelete@Richard

ReplyDelete"We got lucky after the great recession as far as inflation - that people were saving and not borrowing so much."

Interesting but what characterized more the post GFC era was an era of monetary easing with artificially low interest rates which fed mostly through asset inflation and a very significant increase in combined public and private debt. That's how you get unprecedented levels of net worth to income.

What is also interesting since early 2020 is a combination of monetary and fiscal easing which showed the limits of MMT-like policies.

My bet is that, somehow, some kind of rebalancing will occur.

Maybe, 'we' need the Fed to become irrelevant.

Yes, Carl, that is a better way to characterise the post GFC period. Why all that asset inflation did not show up at the consumer level is still a bit of a conundrum.

ReplyDeleteRichard

Interesting thoughts on the "Misery index"/relationship between unemployment and inflation for the index.

ReplyDeleteSome say unemployment rate is doubly (2x) as important as the inflation rate, some say up to 5x (Blanchflower).

https://www.aeaweb.org/articles?id=10.1257/aer.91.1.335

https://economics.dartmouth.edu/people/david-graham-blanchflower

On the other hand:

ReplyDeletehttps://www.researchaffiliates.com/publications/articles/965-history-lessons?evar36=eml_history-lessons-hero-cta&_cldee=jtwJrRvZVxxTwg17xUWaTF6AfkcO49sDOQ8Q2JNKCjt7nZycxFz8ohMJmq2bxcNg&recipientid=contact-e6289710c8cbe2119aa7005056bc3cff-ffc403a870ab419299ff09257799b630&esid=fdb5ee8c-3464-ed11-9562-0022481d0916

re: “Is it possible that inflation will recede to 4% and then to 2% in the coming year or two? Of course, it’s possible! History says it is unlikely.”

ReplyDeleteMoney #s out on 4th Tuesday of the month.

11/21/2022 WSJ

"FED's aggressive rate hikes are a game changer? Monetary policy usually acts on the economy with long and variable lags?"

A decline in legal reserves, or a decline in AD, has an immediate deflationary impact. I.e., contrary to economists:

"I know of no model that shows a transmission from bank reserves to inflation" - DONALD KOHN - former Vice Chairman of the Board of Governors of the Federal Reserve System

"Reserves don't even factor into my model, that's not what causes inflation and not how the Fed stimulates the economy. It's a side effect." - LAURENCE MEYER - a Federal Reserve System governor from June 1996 to January 2002

Richard G. Anderson, world's leading guru on bank reserves:

“Spencer, this is an interesting idea. Since no one in the Fed tracks reserves…”

Bernanke contracted legal reserves for 29 contiguous months which directly caused the GFC.

It's exactly as Lawrence K. Roos, Past President, Federal Reserve Bank of St. Louis and past member of the FOMC (the policy arm of the Fed) as cited in the WSJ April 10, 1986:

ReplyDelete"...I do not believe that the control of money growth ever became the primary priority of the Fed. I think that there was always and still is, a preoccupation with stabilization of interest rates".

Steve,

ReplyDeleteRegarding Research Affiliates. Rob Arnott is always worthy for insight outside of the group think. Still, looking at his flagship fund for navigating real returns shows - at least for 2022 - having clear insight doesn't necessarily translate to better returns in difficult times. His All Asset All Authority is down 19% YTD through Oct. Still again.. thanks for sharing the analysis. At the very least it's helpful to be sober about years to come.

https://www.pimco.com/en-us/investments/mutual-funds/all-asset-all-authority-fund/inst

What the data on the money stock shows, is that the demand for money, decline in savings deposits, has increased the velocity of circulation.

ReplyDeleteScott,

ReplyDeleteAnother excellent M2 number today! Look forward to your thoughts and next write-up -

Thanks!

Tom

https://www.youtube.com/watch?v=rDtVABEzcy4

ReplyDeleteThat's how QE affects the stock market.

M2 hasn't changed for c. 1 year. But DDs have risen. I.e., the composition of M2 has changed. So, the "demand for money" has fallen, and thus velocity has risen. So, short-term money flows are rising at the same time long-term money flows are falling. Until short-term money flows reverse, a recession will not happen.

ReplyDelete09/1/2021 ,,,,, 20957.9

10/1/2021 ,,,,, 21098.0

11/1/2021 ,,,,, 21334.5

12/1/2021 ,,,,, 21660.4

01/1/2022 ,,,,, 21636.9

02/1/2022 ,,,,, 21590.5

03/1/2022 ,,,,, 21855.8

04/1/2022 ,,,,, 21860.3

05/1/2022 ,,,,, 21555.1

06/1/2022 ,,,,, 21585.8

07/1/2022 ,,,,, 21578.9

08/1/2022 ,,,,, 21546.5

09/1/2022 ,,,,, 21459.4

10/1/2022 ,,,,, 21362.5

Salmo, is this a good measure of DDs? https://fred.stlouisfed.org/series/DEMDEPSL

ReplyDeleteIf, so...haven't DDs fallen for 2 months now?

August: 5239.5

September: 5179.3

October: 5126.5

Granted a more "normal" range would be something much closer to 2000 or less, so at what point would you classify DD's as reversing or falling? When is it a meaningful decline?

DDs rate-of-change, short-term money flows, proxy for real output, is rising. And Atlanta's gDpnow confirms this. And you don't use the seasonally mal-adjusted #s.

ReplyDeleteTotally agree with your premise. I'm just trying to find a reliable measure of DDs so I can follow along with your logic as things progress. What source do you use to track demand deposits?

ReplyDeleteDan Thornton is correct. “Money Supply and Inflation: Where’s the Proof?” WSJ July 21, 2022

ReplyDeleteLink: George Garvey:

Deposit Velocity and Its Significance (stlouisfed.org)

“Obviously, velocity of total deposits, including time deposits, is considerably lower than that computed for demand deposits alone. The precise difference between the two sets of ratios would depend on the relative share of time deposits in the total as well as on the respective turnover rates of the two types of deposits.”

https://fred.stlouisfed.org/series/DEMDEPNS

ReplyDeleteGrannis deleted my time series.