Yesterday's release of the second estimate of Q3/18 GDP growth was largely unchanged from the first (+3.5%). If there's anything disappointing in the news, it's that the economy is not stronger, given that corporate profits are very strong. According to the latest NIPA data, after-tax corporate profits rose 19% in the year ending Sept. '18. According to GAAP (reported) profits, earnings per share for the S&P 500 rose over 22% in the year ending Oct. '18. Fabulous profits, indeed, but business investment remains moderate, and that is a big reason the economy is not stronger.

Trump has managed to reduce tax and regulatory burdens in impressive fashion, but his tweets and his tariff threats have created unnecessary distractions and unfortunate uncertainties, not to mention higher prices for an array of imported consumer goods. He's made America better, but not Great. Getting past the threat of trade wars, especially with China, will be the key to unlocking the future growth potential of the US economy, which remains Yuge. All eyes will be watching for the results of Trump's meeting with Xi in Buenos Aires later this week.

Chart #1

Thanks to plotting real GDP on a semi-log scale, Chart #1 makes it easy to see that the ongoing economic expansion has been the weakest in history. For many decades the economy averaged 3.1% annual rates of growth. But since the Great Recession ended in mid-2009, the economy has averaged only 2.3% annualized growth. Things have picked up a bit of late: in the year ending last September, growth was 3%. A decade of sub-par growth has created a potential GDP "gap" of at least $3.2 trillion. In the past year alone, the US economy has missed out on over $3 trillion in income—which averages out to over $20,000 per worker—that could have been earned if the economy had kept up with its previous trend.

Chart #2

Chart #2 compares the 2-yr annualized growth rate of GDP with the real yield on 5-yr TIPS. There's a strong tendency for real yields to track the growth rate of the economy. Real yields began to rise just after the November '16 election, from -0.4% to 1% today. The outlook for the economy has improved, but we're still looking at moderate rates of growth in the 2.5-3% range. To get excited we'll need to see growth rates of 3-4%, and real yields of 2% or better. I remain optimistic that this will occur, but we aren't there yet. More confidence and more investment are what's needed, and a lower-tariff solution to our mounting China angst would be a wonderful tonic in that regard.

Chart #3

Chart #3 shows real gross private domestic investment. Like GDP, investment has been rising at a sub-par rate for the past decade. We need to see a lot more investment for the economy to get exciting. Chart #18 in my previous post shows a proxy for business investment—capital goods orders. They've been very unimpressive by historic standards. We've seen some nice improvement since late 2016, but this needs to continue.

Chart #6

Chart #4 compares after-tax corporate profits to nominal GDP, and Chart #5 shows the same profits as a percent of GDP going back 60 years. Corporate profits these days are close to their strongest levels ever relative to the economy, roughly 50% higher than their long-term average. Is it any wonder that the PE ratio of the S&P 500 (18.76 today, according to Bloomberg) is higher than average (16.85)? (see Chart #6)

Chart #7

If there is any message in the charts #4-6, it's that the market doesn't believe all this good news will last—despite record-level profits, valuations are only moderately above average. Chart #7 shows the risk premium that investors demand to hold stocks instead of risk-free 10-yr Treasuries. If PE ratios remained at today's level (18.75), and if corporations paid out all their profits in the form of dividends, then the dividend yield on stocks would be the inverse of the PE ratio: 5.33%. Yet if this were certain to persist, then only a fool would pass up stocks in favor of lower-yielding Treasuries. Instead, investors apparently figure that the corporate profits are likely to decline meaningfully relative to GDP. I made this same point three years ago and also seven years ago.

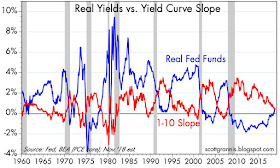

Chart #8

Chart #8 is one of my favorite recession-watch charts. Every recession has been preceded by a significant tightening of monetary policy, and that tightening can be measured by 1) a relatively high real Fed funds rate (2-3%), and 2) a flat or inverted Treasury yield curve. Currently the real funds rate is a bit less than 0.5%, and the yield curve remains positively sloped. Neither are threatening a recession, and neither is the Powell Fed. (I should note that the recent increase in the real funds rate is mainly the by-product of a decline in the PCE Core inflation rate.)

Chart #9

Finally, Chart #9 updates one of my favorites.

Scott; Great post(s) on the market ‘panic attack’. I took the opportunity to add new money in my Fidelity account FZROX (zero fee US total market as the market sold off, buying on down days only, and recently bought two iPhone Xr’s and Apple Watch 4.

ReplyDeleteStocks climb a 'wall of confidence',

ReplyDeletenot worry.

That confidence peaks at the stock market peak.

The 'wall of worry' saying was used by

Wall Street salesmen to assure customers

that "now" is always the best time to buy.

Always bullish.

Always selling.

That's how the industry works.

Not for their own traders, of course,

just for the outside customers!

September and October 2018 economic data releases

ReplyDeletewere worse than I've seen in years.

Two months are not a long term trend,

but they should be considered as bad news.

They are easily seen in the real economy data

I publish in my economics blog:

https://el2017.blogspot.com/2018/12/economic-data-releases-in-past-month.html

Hi Scott,

ReplyDeleteI am a Financial Advisor and a huge Nick Murray fan. He recently turned me onto your blog. I would like to quote you in a letter to my clients. Specifically your comment: "Trump has managed to reduce tax and regulatory burdens in impressive fashion, but his tweets and his tariff threats have created unnecessary distractions and unfortunate uncertainties, not to mention higher prices for an array of imported consumer goods."

May I use this quote from you while giving you the proper credit? Do I have your permission?

Thanks

Brad Rice

Brad: You have my permission

ReplyDelete